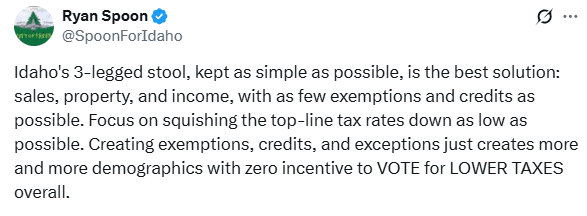

Every so often, you’ll hear political activists and politicians toss around the term “three-legged stool” when talking about taxes. They say it with a straight face, as if it’s a balanced, sensible plan for funding government. The idea is simple: the state should get its money from three sources: property taxes, sales taxes, and income taxes. Each is a “leg” of the stool, and together they create a stable base.

In their view, if one leg gets wobbly, the other two can hold everything up. To them, that’s smart fiscal policy. To me, that’s a red flag.

The truth is, the three-legged stool is not conservative in any sense of the word. It’s not about limited government, personal freedom, or fiscal responsibility. It’s about ensuring government is always well-fed. It’s about creating a system where government never has to go without, no matter how reckless its spending habits get. A household that overspends is forced to cut back. Under the three-legged stool, government just leans harder on another tax and keeps spending like nothing happened.

The worst part is how completely this model entangles government in every part of your life. Let’s be clear: income tax is a direct hit on your labor. You work, you earn, the government takes a piece before you even see your paycheck. Sales tax hits you every time you try to buy something, whether it’s groceries, clothes, or a cup of coffee. And property tax? That’s the one that proves you never truly “own” your home or land, you’re essentially renting it from the government for life. Don’t pay the rent, and they’ll take it away, even if you’ve paid off your mortgage.

Now imagine all three of these running at once, working together like gears in a machine. That’s not a “balanced system.” That’s a machine designed to pull money out of your pocket in three different ways so the state never has to skip dessert.

From a conservative perspective, this whole philosophy is upside down. True fiscal conservatism starts with the question, “How much should government actually be doing?” From there, you figure out the smallest amount of money needed to accomplish that. The three-legged stool flips that on its head. It starts with the assumption that government has an endless list of things to do and then asks, “How do we make sure we always have enough money to do it?”

This isn’t just about taxes, it’s about control. When government has three strong and reliable revenue streams, voters lose the power to hold it accountable. If the state depends heavily on one tax, cutting or reforming that tax becomes a way for citizens to demand change. But with three legs under the stool, knock one down and the others get longer to keep everything level. It’s practically designed to make reform harder.

Defenders of the three-legged stool will tell you it’s about “stability” and “predictability.” What they really mean is stability for government, the people collecting and spending the money, not stability for you, the taxpayer trying to budget for your own family. They love the stool because it shields them from the consequences of overspending. When revenues dip in one area, they don’t have to cut waste or cancel bad programs; they just lean on the other two taxes to fill the gap.

This approach is the exact opposite of what we should be doing in Idaho. If we want to live within our means, we need a leaner, simpler tax structure, one that limits the number of ways government can reach into your wallet. A single, limited revenue source forces discipline. The three-legged stool eliminates it.

Conservatives talk about shrinking government, but you can’t shrink anything that’s built with redundancy in mind. The stool is a safety net for big government, and it’s been sold as “good policy” because it sounds balanced.

Don’t buy it.

Balance in government doesn’t come from building stronger tax systems; it comes from spending less, cutting waste, and respecting the taxpayer.

At the end of the day, the three-legged stool doesn’t balance the load, it just balances it on your back.